Many people who collided with the problem of a significant amount asked. How to write a literacy receipt and whether it will be legal.

In independence, the document is called arbitrary, but is legal. In the event that financial or other values \u200b\u200bare not returned to borrowers at the agreed period.

The debt detection indicated in the legislation of the Russian Federation is a significant implementation of the law applied directly in civil relations. A detailed description of the legality of the document is indicated in Article 808 of the Civil Code of the Russian Federation.

Paragraph2 states that the meaning of the recorded main contract is provided to the receipt to be provided as a complementary document. We should not forget that it is necessary to present it directly as a separate legal document.

When applied

In the Civil Code of the Russian Federation, there is an article 408 in which it is said that the lender accepting the execution of the debtor is obliged to write a document execution document or partially. After paying the debt, the borrower is obliged to return the corresponding receipt.

Due to the inability to return in the subsequent document. In the form of a creditor failure to give a receipt, the debtor is entitled to detain the execution.

The display also confirms the condition of business transaction in business, receiving documents, expensive valuable items. The document also contains the provision of services or the intention of any action. To do this, specify the service of any kind and the term of rendering. The document must be written in writing and the relevant commitment.

There are also such leopards that use the dependent financial position of a person taking. Offering big interest on loan has the ability to demand a long-term calculation. With the specified percentage of destination in the receipt of this fact, you need to be afraid and not to find yourself in the credit pam.

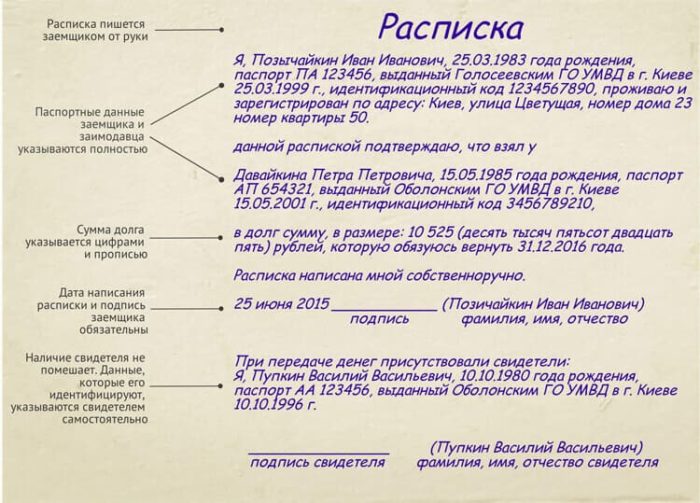

How to write a receipt

The transaction is considered perfect and plays a role in transmission of money, and not from the moment of its signing. Without transmission of a cash loan, the contract cannot be considered concluded. There is another way: a contract is drawn up, and cash transmission to designate in the document.

Payment order will be the fact of confirmation of the transfer of funds to the current account of the borrower, but is primarily a contract. The loan agreement may be written that the financial resources are obtained at the time of signing the contract. Also on obtaining cash can be competently entered into the contract.

The debtor must write a receipt to the presence of a borrower and sign. In the event that he will provide a deception without its signature, then, with the required examination, it may not be proved in this transaction

Regulations

For minimal risk with a possible refusal to return funds, and recognition illegal. All nuances of the rules for filling the receipts are required to comply with:

- Compiled by the document without the use of any printed machines and other devices, in case of possible examination for presentation in court.

- Financial Sumy are written by numbers and in words.

- With currency filled in the value of the exchange rate at which the return will be made.

- In the case of an interest-free loan, the document does not provide information about interest.

- At the time of writing, the document should be specified by the fact of transfer of funds on time.

- Must be indicated (place, city, district) to the compilation of receipt.

- The receipt for finances invested in the business project is regarded as commercial risk and funds are not subject to return.

- And also verify the passport details of the borrower with the specified in the receipt.

In cases of the general rule, the contract in the receipt, with the condition of interest was compiled without indication of the size, then it is equal to the banking rate. The document also can specify that it is without percent. But in that case, if the debtor broke the payment time on the obligation to refund finance. In the next period, the percentage may be repaired, as responsible for the use of Article 309 GK of the Russian Federation.

Mandatory details

The debtor of the extended credulity of the lender, without denoting the details in the preparation of the receipt can be evincible from the return of the loan. To avoid any disputes, you need to make a receipt correctly.

Sample:

I Ivanov Ivan Ivanovich residing at: Altai region Barnaul st. New D.65 sq.7. A series of document No. 333777 issued from 03.03.2000. Inn 8 ....... Received 02.02.2017. FULL NAME (FULLY) Living at the address (fully) also document data. Ten thousand rubles (for any needs). The specified amount I undertake to return to the full volume before (the date of the date is completely), in case of delay, pay a penalty in the amount of two percent per day.

Number. Painted. Signature (Ivanov. I. and).

This method is drawn up, etc.

Better not to make an error Make a copy of the recipient's passport data, and should also write; (Money is transferred to debt). Burner is obliged to write the text of the receipt in receipt of money. In the case of something written something else, the debtor can deviate one debt obligation.

7 mandatory compilation requirements

The most important thing is to compile, 7 mandatory details must be respected:

- Full name of the lender and borrower.

- Registration address, TIN, and full passport data of both parties.

- Loan object (figures and in words).

- Date, place and very fact in teaching.

- What time is the return of debt.

- For what he is given.

- The surname is always completely, initials and signature.

Do I need to make a receipt in the presence of a notary

Some citizens consider that in the very case the document does not require such a certification. Because he will not betray the considerable strength he already has.

Although the reference to the notary may carry an additional character of confirmation. In that, that it is not falsification and was compiled, in the presence of both stakeholders. And he was signed by the face capable exclusively without any pressure.

In the case when the foundation occurs in quite large sizes in order for all the bound risks of the loss of funds to reduce to zero. It is required to compile a certain interest-free loan agreement, which has a large legal basis.

Does it be necessary to write a receipt from hand?

Errors allowed when drawing up

An indication of the goal of the loan is unprofitable for the very lender. In cases where in the document it will be indicated that the challenge is taken to commercial needs. The unfinished borrower may refer to the unfavorable state of affairs and has the right to do not give money at the specified period.

There are cases that the debtor thinks in advance the ways to make a receipt to get away from responsibility. Sometimes the situation is not in favor of the lender, due to the credulity or ignorance of the rules of compilation.

In what fact of the contract violations will require a court intervention? Different situations are possible if the receipt was confirmed. The borrower within the prescribed period is not in a hurry to return the appropriate amount, then you need to go to court.

But still, before contacting this fact, it is necessary, first of all in writing to demand the return of money from the debtor. Only in the case of a month after the expiration, the notifications did not bring any result, you can apply for a claim.

To prepare a compelling claim, it is advisable to apply for the advice of the Legal Department. To the leading specialist where you will help you draw up.

Is it possible to demand a refund through the court. Having evidence in the form of an extract from the bank on which it is indicated that funds were translated into the account of the debtor. To do this, you need to make requirements, hand the borrower and insist on the return of the entire amount in a 3-month period.

This procedure is established by Article 810 of the Civil Code of the Russian Federation if the established amount of debt will not be returned, then this can be applied to the court.

Note: The limitation period is 3 years, from the beginning expiration of the return period. In the event of an expiration, the claim will be denied.